Mobile App Highs and Lows: The MVP’s of 2020

According to the all-new Global Mobile Consumer Trends Report, 2020, published by MoEngage- Healthcare and Education Apps are the MVPs of mobile consumption- In Q2, 2020, Health & Fitness apps saw an increase of 45.66% in the number of global mobile app downloads from Q1, 2020.

Quick Links

The report identifies data patterns of 1.5 billion mobile app users spread across 5 different geographical regions. Data in this specific report reflects consumer confidence trends in different industries in Q2 2020.

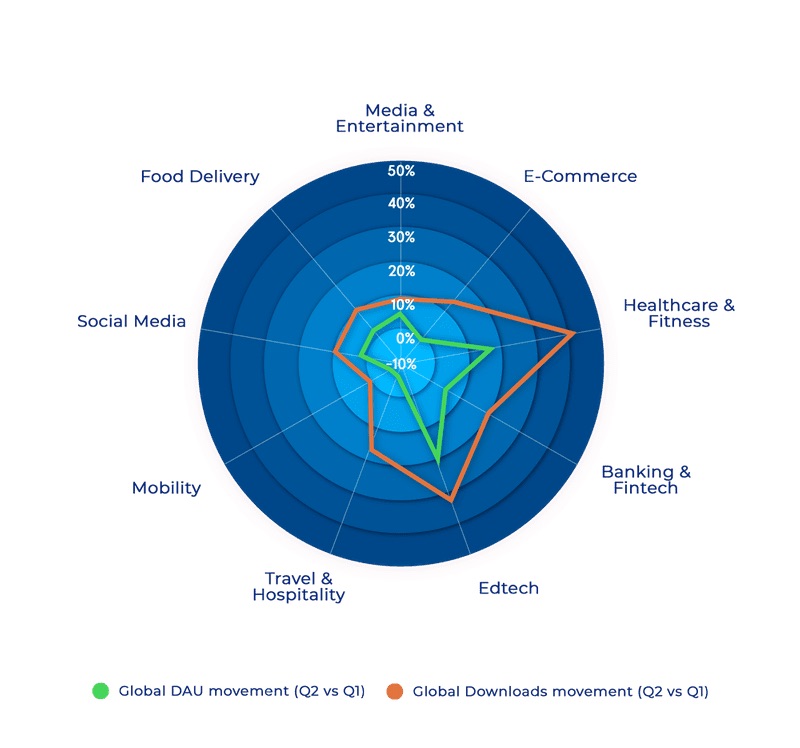

A look at the Global Industry Radar shows Edtech, Banking & Fintech, and Healthcare & Fitness have seen steady growth in both DAU & Downloads in Q2, 2020(April to June).

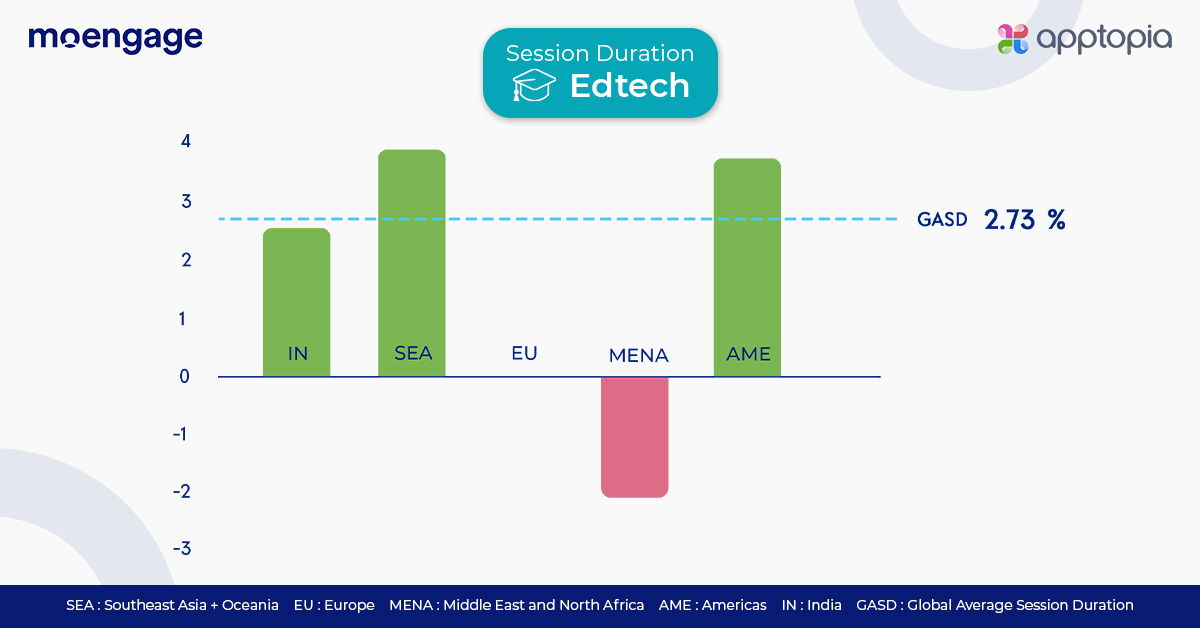

Edtech Apps keep up the Momentum

- Globally, edtech apps have seen an increase in DAU (22.39%), downloads (34.14%), frequency of usage (31.18%) and the average session duration (2.73%).

- Southeast Asia saw the biggest jump in the average session duration (3.80%), whereas the Middle East and North Africa region is the only one to have seen a decrease in the average session duration (-2.03%).

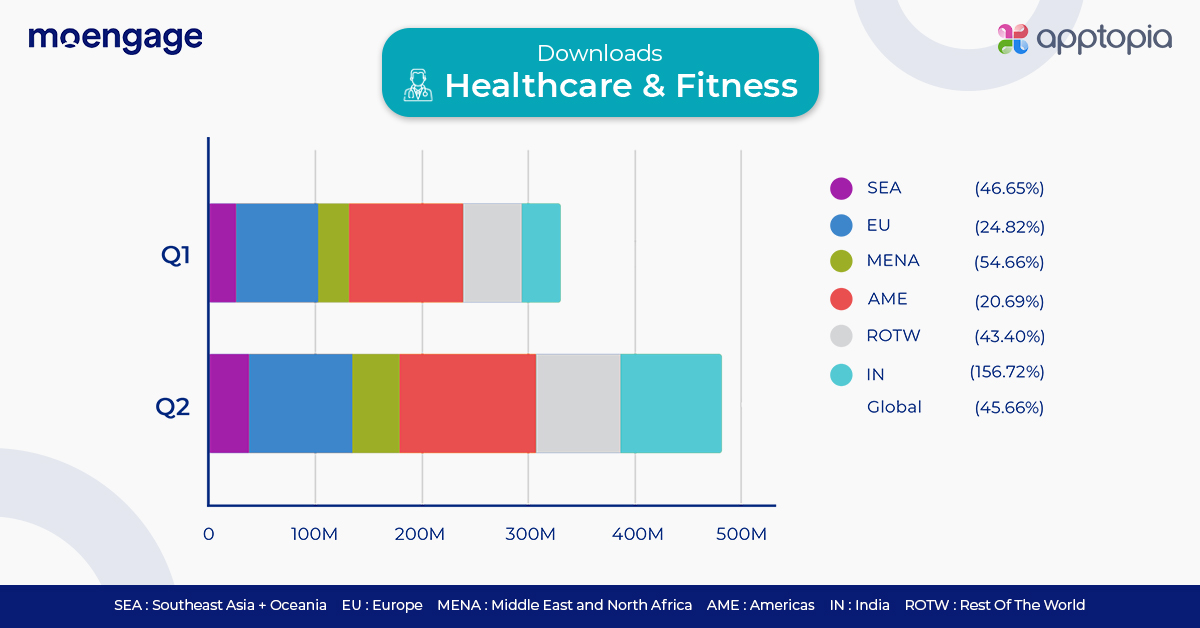

Health and Fitness Apps are on a High

Healthcare and Education Apps are the MVPs of mobile consumption- In Q2, 2020, Health & Fitness apps saw an increase of 45.66% in the number of global mobile app downloads from Q1, 2020.

- Global rise in downloads of fitness apps in Q2 vs Q1 was 45.66%.

- The boost to global downloads of fitness apps in Q2 globally was driven majorly by India (156.73%), which translated to 58 million active users.

- Global rise in daily active users of fitness apps in Q2 vs Q1 was 24.04%.

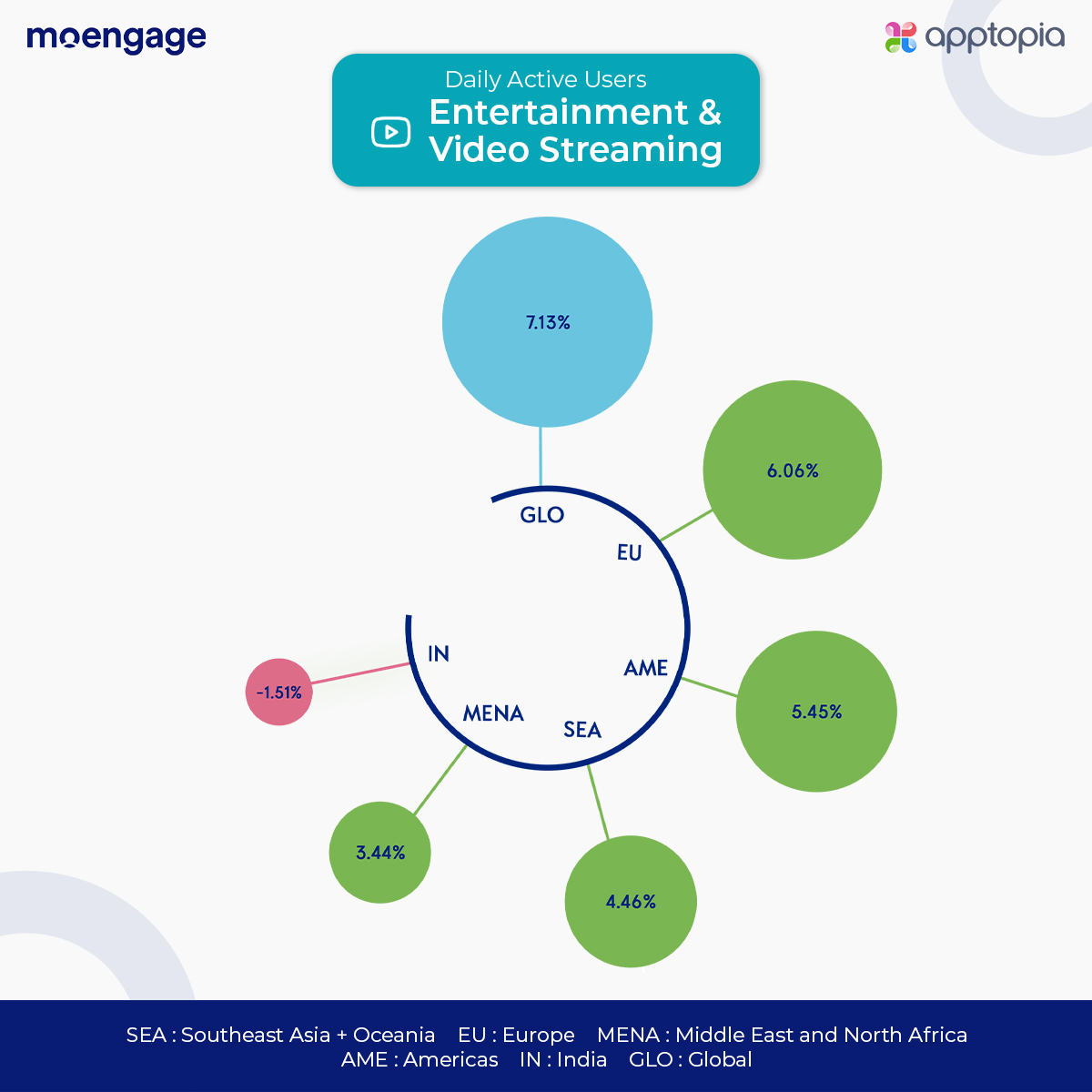

Media & Entertainment Apps Stay Steady

- Countries in the Middle East and North Africa, Europe and the Americas had the highest number of new users for video streaming (OTT video) apps.

- The Middle East and North African region has seen the highest increase in downloads (19.72%), which is higher than the global average (16.80%).

- Growth in user activity was the highest in Europe (6.06%), followed by the Americas (5.45%).

With the lockdown lifted, there is no guessing people are still wary of stepping out and resuming activities like before. This has resulted in a strong permanent shift in user behavior which has forced marketers to look at their engagement strategy and rethink their approach. While the digitally savvy industries such as Media & Entertainment, Social Media, E-commerce, Food Delivery and Gaming continue to grow in strength, with 4 months left in this year, these trends may remain the same.

What Is WooCommerce Product Slider and Why Your Store Needs It

Why Do Product Images Matter So Much in Online Stores? When someone visits an online store the…

0 Comments9 Minutes

How to Streamline Your Customers’ Shopping Experience?

The goal for any online store is to make shopping as smooth as possible. When visitors move…

0 Comments8 Minutes

Strengthening Brand-Customer Relationships Through Gamified Loyalty Programs

Creating lasting connections with customers has become increasingly vital as the marketplace grows…

0 Comments6 Minutes

How to Use SEO and SEA Together in Search Engine Marketing

In digital marketing, search engine marketing (SEM) plays a critical role in improving online…

0 Comments10 Minutes

Content Marketing Growth Hacks: Real Shortcuts to Drive Traffic

Are you still lagging in content marketing? Sticking to these old strategies seems…

0 Comments10 Minutes

How to Build a Strong Local Following Using Social Media Marketing

In the days of likes, shares, and stories, local businesses have a golden opportunity to create…

0 Comments9 Minutes

Why WooCommerce is the Best Choice for Your Online Store?

WooCommerce stands out as a top option for anyone looking to build an online store. This platform…

0 Comments8 Minutes

How to Use AI-Powered SEO Tools for WordPress eCommerce

SEO is a critical factor in the success of any e-commerce WordPress store. As competition…

0 Comments11 Minutes